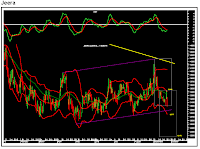

NCDEX jeera is moving up in a channelised manner

NCDEX jeera is moving up in a channelised manner since the beginning of February. It has formed a channel within a channel. The move that has started from the March low has now reached near a crucial resistance zone. This leg has achieved 161.8% of the equality target and retraced 78.6% of the previous fall. It has also halted near upper ends of both the channels. The short-term momentum indicator has been stretched to the overbought zone. Thus the agri commodity can go for a correction. Rs16,670-16,625 will be the key area on the downside. On the higher side, Rs17,670-18,185 will act as a key resistance area.